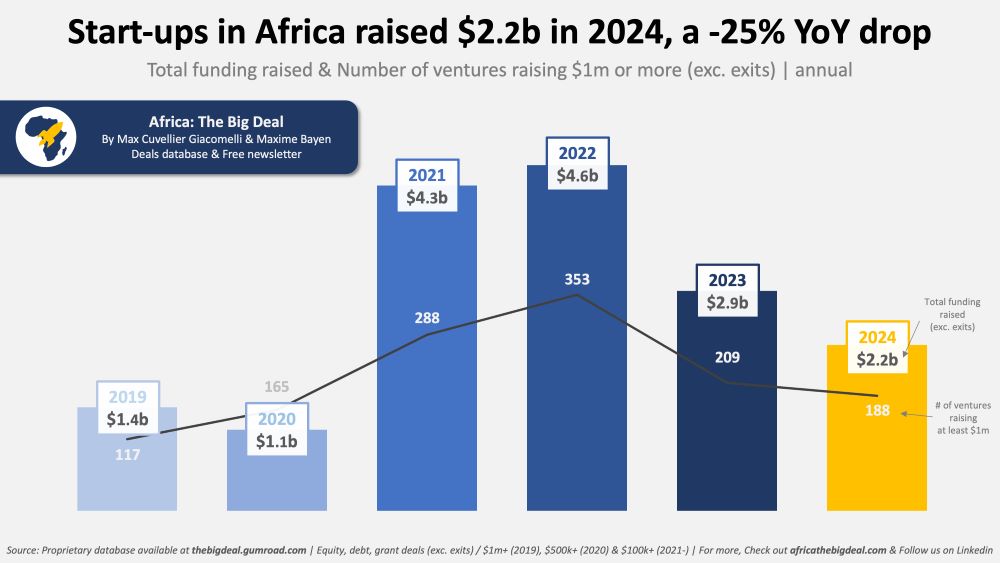

Start-ups in Nigeria, Kenya, South Africa and others on the continent raised $2.2 billion last year in equity, debt and grants (exc. exits), according to latest data compiled by Africa: The Big Deal.

While this is a good amount in absolute terms, it represents a -25per cent drop when compared to the $2.9billion that were raised on the continent in 2023. A total of 188 ventures raised $1million or more in 2024 (exc. exits), which is just 10per cent less than in 2023 though. On the exit front, there were 22 exits made public last year, versus 20 in 2023.

According to the report, the relative counter-performance of 2024 is mostly to be blamed on a slow start of the year: just under $800million raised in half year (H1), the slowest semester since 2020.

However, there was a serious rebound in the later part of the year as $1.4billion were raised in H2 alone (+25per cent year-on-year (YoY) and +80 per cent compared to H1), which made it the second-best semester since the beginning of the ‘funding winter’ in mid-2022.

The numbers were driven in part – but absolutely not in full – by the two mega deals of Nigeria’s Moniepoint and Tyme Group in Q4, minting two new unicorns back-to-back, the first such events since early 2023.

Just as curtains were being drawn on this year, Tyme announced a $250million Series D round, and a valuation of $1.5 billion, meaning it is now Africa’s ninth unicorn, just a few weeks after Moniepoint also gained unicorn status after announcing its Series C.

Starting in the early 2010s, one start-up in particular made headlines in Africa, repeatedly, by raising cash in volumes never heard of before, and that is not heard of again until the end of the decade. It is called Jumia. Between 2012 and 2014, the e-commerce start-up is said to have raised more than $200million, culminating in a $300million round for its parent company Africa Internet Group in March 2016, earning AIG its ‘unicorn’ title.

The company continued to grow until its listing on the New York Exchange (NYSE) through an Initial Public Offering (IPO) in April 2019 (therefore automatically giving up its unicorn label). From an initial market cap of $3billion, it then dropped dramatically, went back up to $5billion, but has mostly been again below the $1billion mark since early 2022 (at the time of writing, it is around $600million).

Another company sometimes mistakenly identified as a unicorn is Egyptian fintech fawry. Fawry went public on the Egyptian stock exchange in 2019, reaching a $1 billion valuation as a public company rather than a private start-up. Although its market cap exceeded $1billion for an extended period, it currently stands at approximately $600million.

Africa’s current unicorn list, in chronological include Interswitch which made the first. The Nigerian fintech kicked things off when it announced a very large investment from Visa in November 2019 (estimated at $200million), opening a new season of nine-digit rounds on the continent. With a valuation of $1billion, it was most likely the only unicorn on the continent at the time, reaching this status 18 years after being founded in 2002 (while the average for its future peers will be five years). The start-up then announced a new funding round of $110 million in May 2022, but did not comment on its valuation at the time. Without any indication that this could have been a ‘down round’, it could be assumed that Interswitch retained its unicorn status.